I am excited to share this country deep dive with you. I visited this beautiful central European country in 2019 and was amazed how little I knew about it. I try to bring interesting investment opportunities you will not hear anywhere else, and Slovakia fits that criterion. In this deep dive we look at the economy, real estate market and investment potential of Slovakia.

Location: Central Europe

Local Financing for Foreigners: Yes (but not easy)

Currency: Euro

Rental Income Tax: 19% and 25% above €47,537.98 (60% deduction can be made)

Property Taxes: €0.033 per square meter

Estimated Net Yields: LTRs from 3%-6% (6% to 15% for STRS).

Average Price Per m2: €1,393-€3,127 per m2 (Nitra to Bratislava)

Restrictions on Foreigners: No except agricultural lands

Capital Gains Tax: 19%

Economy

GDP

According to the EU’s economic forecast, GDP is expected to grow 2.2%, 2.3% and 2.5% in 2024-2026. Historically, GDP has grown on average about 4% per year with a record high in 2007 of 10.8%. The anticipated growth is driven by strong government consumption and increased demand for exports. The 2025 VAT tax increase and increased inflation is expected to weigh on domestic demand. The economy is commonly known as the “Tatra Tiger” and is made up of a robust service and automotive sectors. Slovakia is one of the largest car producers in Europe, producing about 1.1M cars in 2023.

GDP by sector is about 27% industry, 60% services and 2% agriculture. Slovakia’s main industries and exports are motor vehicles and parts ($33.5B), Machinery ($30.4B) and Iron/Steel ($5.8B). Their top exports destinations are Germany, Czechia, Poland and Hungary. The regional concentration of trading partners is problematic, and the current government is working to trade more outside the EU. Total exports increased from €80B in 2017 to $112B in 2023. Total imports have also increased, but they only had 2 years of trade imbalances the past 8 years in 2021 and 2022. The services sector employs about 61% of the workforce and is mainly retail, real estate and tourism.

Public debt is expected to increase to 58.9% in 2024 and continue to 61.8% of GDP by 2026. This trend is driven by anticipated deficits only partially offset by GDP growth. The government has increased spending to increase wages and energy support. The expected trend is not a good one, but I think given the 2025 tax increases, easing in geopolitical tensions and increased trade with non-EU countries, they will outperform projections.

Labor Market

The unemployment rate is expected to continue to decline from 5.5% in 2024 to 5.2% in 2026. The market is tight with strong labor demand and real wage growth. The labor force continues to decline despite increased participation rates and foreigner workers. Real wages grew 3% in Q3 24 an ease from 4.8% increase in Q2 to a total of 1,989 average monthly wages. Some challenges are a shortage of skilled labor and the education system.

Real Wage Growth

Participation Rate

Energy Troubles and Inflation

Slovakia was in the news recently over its dispute with Ukraine over the decision to cut off the transit of Russian gas. Slovakia historical has relied on Russian gas and the conflict in Ukraine has strained the economy and increased inflation. To alleviate the impact of higher energy prices the government-imposed subsidies and financial support to citizens in 2023, but those measures are expiring in 2025. Ukraine’s decision to cease the transit of Russian gas forces Slovakia to purchase LNG and other more expensive energy alternatives, pushing energy prices up. Inflation was 3.1% in 2024 due to the government interventions but is expected to rise to 5.1% in 2025.

Demographics

The total population increased 0.82% in 2023 to 5.5M but expected to decline in the near-term. Like much of Central Europe, the birth rates are declining, and the median age continues to increase. Compared to its neighbors the demographics look better but still aren’t great. Over 53% of the population live in urban centers and the population trend remains positive in the major cities. Bratisalva, Kosice and Zilina saw moderate growth of 1.5%, 0.8% and 0.5% respectively in 2023.

Tourism

Slovakia is centrally located and has a lot to offer from national parks to castles. Bratislava (capital area was most visited by foreign tourists followed by Zilina, Presov and Banksy in Q1 and Q2 of 2024. In those two quarters over 2.5M tourist visited, a 3% increase from the previous year. In 2023, total tourists visited was 2.1M, record high and 31% more than 2022. The tourism sector was significantly impacted by the pandemic and decreased from 5.5M tourists in 2019 to the current level. However, the trend pre-pandemic was positive and will likely recover and exceed pre-pandemic levels. The majority of foreign tourists come from local countries, the Uk and China. The average length of stay is 3 days.

Tourists visited

2014: 4,300,000

2015: 4,500,000

2016: 4,800,000

2017: 5,000,000

2018: 5,299,000

2019: 5,475,094

2020: 1,303,000

2021: 575,687

2022: 1,594,148

2023: 2,084,239

2024: 2,475,094

Real Estate Market

Property prices fell 10.7% and 6.6% in Q3 and Q2 of 2023 due to high interest rates, geopolitical tensions and energy prices. I would add the decline was exacerbated by the pandemic effect given the artificial price jump post-pandemic. Between 2020-2022 property prices grew 16%, 25% and 15% respectively. Q2 2024 prices continued to fall but only by 1.28% pointing to stabilization. Before the pandemic, there was steady property price growth of about 4% annually. To speak to liquidity, flats and properties in the city centers are easier to sell and the farther out the less liquid.

Bratislava

Average Price (2024): €3,127 per square meter

Capital Appreciation (2014-2024): 39%

Trnava

Average Price (2024): €1,837 per square meter

Capital Appreciation (2014-2024): 25%

Nitra

Average Price (2024): €1,393 per square meter

Capital Appreciation (2014-2024): 28%

Trenčín

Average Price (2024): €1,569 per square meter

Capital Appreciation (2014-2024): 27%

Žilina

Average Price (2024): €1,819 per square meter

Capital Appreciation (2014-2024): 27%

Banská Bystrica

Average Price (2024): €1,562 per square meter

Capital Appreciation (2014-2024): 25%

Košice

Average Price (2024): €2,087 per square meter

Capital Appreciation (2014-2024): 30%

Demand has and continues to outpace supply with especially with new a slowdown in new construction. In 2023, the construction sector’s share of GDP fell to 4.9% from 7.5% in 2018 and the long-term shortage is about 350,000 dwellings. Real estate transactions are expected to be down about 5% from 2023 to below pre-pandemic levels (34,000) after a 6% increase in 2023. I think this proves my earlier point that the market is trying to correct itself. Home ownership is over 90% in Slovakia, the second highest in the EU.

The rental market is strong with steady demand and rising rents given supply constraints and economic growth. Vacancy rates are also low and expected to remain that way.

Investment Potential

Short-term Rentals

The most visited places in Slovakia are Bratislava, High Tatras, Košice, Banská Bystrica and Piešťany. An apartment in central Bratislava will probably be the most lucrative and easy to manage.

Property Managment Fees: 17%-25% (there is a great firm that offers full management and setup assistance. Contact me for more info)

Regulatory Environment: Friendly

Example apartment used in the case studies

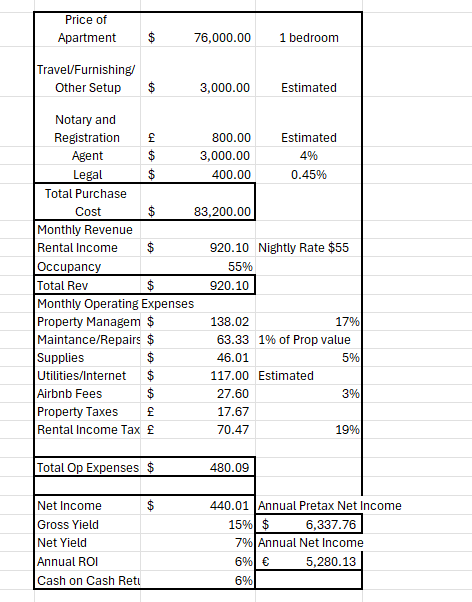

Case Study STR in Bratislava (not in the city center so lower nightly rate)

STR yields can be higher, but I tried to be as conservative as possible. Property taxes in Slovakia I am not clear on. I saw sources saying 0.0333 per 1 m2 which would drastically decrease the number I showed.

Long-term Rentals

Gross yields on average are about 5%-6%. I think you can get better in Nitra, Kosice and the outskirts of Bratislava.

Property Management Fees: 8%-10%

Pro-Landlord

For those who have been following this newsletter you know I am very into investing in cities with large student populations. And in Slovakia the largest university is in Bratislava, but the third largest is in Kosice. Cities with large student populations are great investments given the very stable rental demand.

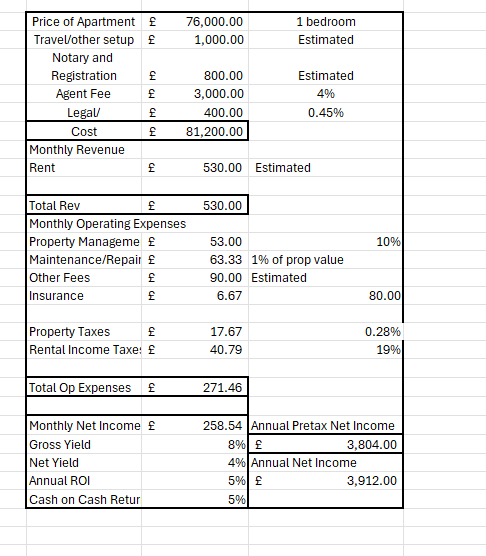

Case Study LTR in Bratislava (not in the city center)

You can probably get higher rent for this property because of the location, balcony and condition but I tried to stay conservative. And again, property taxes may be lower.

Conclusion

I think Slovakia is a sound investment for LTR and STR. Yields are lower than some other locations we have analyzed, but the overall trends are positive. Tourism is robust and will continue to grow. Capital appreciation and wages will continue to rise given the stable economic growth. Downsides are property prices are higher than neighboring Hungary and Romania, that both have similar economics and demographics. I think Slovakia economically is stronger than Romania, but Budapest (Hungary) might be a better investment based on yield and capital appreciation. Another downside is the limited access to financing for foreign nationals. My understanding is banks are hesitant to loan to foreigners. All that being said if you are looking for a solid long-term investment in Central Europe, Slovakia is definitely a top contender.

Ready to invest abroad but need help or don’t know where to start. Contact me today for a free consultation to make the process as easy and passive as possible.

Investabroadllc.com

Info@investabroadllc.com