Qatar

Deep Dive #12

Howdy. I know we recently looked at Abu Dhabi, but this region is full of great investment opportunities, and Qatar is no exception. In this deep dive we will look at the economy, real estate market, investment potential and a LTR case study. Ok let’s jump in…

Location: Persian Gulf in the GCC

Local Financing for Foreigners: Yes

Currency: QAR (Qatari Riyal)

Rental Income Tax: 0%

Estimated Net Yields: LTRs and STRs from 4%–7%

Property Prices: $1,620 – $5,400 per m²

Economy

Before the 20th century, Qatar’s economy was based on pearling and fishing with Doha just a small modest port. The nation declared independence in 1971 after being a British protectorate from 1916 to 1971. The economy had a massive transformation with the discovery of oil in 1940s and the North Field (the largest non-associated natural gas field in the world) in 1971. By the early 2000s, Qatar emerged as a top liquefied natural gas exporter. Qatar started diversifying away from energy in 2010s with sectors like finance, logistics, tourism and manufacturing. The government has also made significant investments in higher education, tourism, AI technology and infrastructure.

GDP

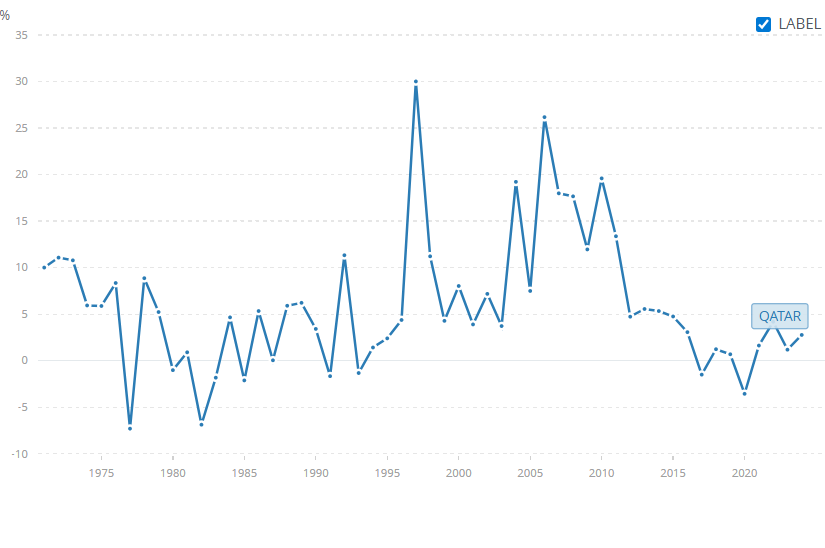

Total GDP is about $180B with GDP per capita of about $60,000. Q2 2025 GDP grew 1.9% down from 3.4% in Q1 2025. The Q2 growth was driven by non-oil sectors (up 3.4%) specifically agriculture (15.8%), tourism (13.4%), and retail (8.8%). According to the IMF, GDP is expected to grow 2.9% and 6.1% in 2025 and 2026. The 2025 forecast is based a stable LNG market and continued growth in non-oil sectors (tourism, tech, construction etc). The 2026 forecast is based on the expansion of the North Field output and steady growth in the logistics and tech sectors. GDP grew 1.9% and 2.7% in 2023 and 2024. From 2005-2025, GDP grew on average about 4.2% annually with a peak of 14% in 2006 and low of 3.6% in 2020 (Covid-19). Debt per GDP was about 40% in 2024 and is expected to decline to 30% by 2026. The GDP breakdown is about 34% energy, 8.9% services, 7.4% manufacturing, 12% finance/tech, and 11.8% constructions. Qatar has a trade surplus of $4B and top export partners are Japan, South Korea, India, and UAE.

GDP Growth

Tourism Sector

2022 World Cup

The government spent about $220B making it the most expensive World Cup in history (15X 2018 Russia World Cup). They built about 8 stadiums, 100 hotels and made general improvements to local infrastructure to accommodate for the 1.4M international visitors. Many criticized Qatar as a venue because it was too small, too conservative etc. But Qatar stepped up and the event was a success. Post-World Cup the government is positioning itself as a regional sports hub hosting the FIVB Volleyball Men’s World Champ this year, the Asian Games in 2030 and making a bid for the 2036 Olympics. Some argue the World Cup economic momentum was weaker than it should’ve been and the government spent more than it gained. In the short-term that might be true, but the event put Qatar on the map, and the true impact is too early to tell.

The tourism sector contributes to 8% of total GDP and the government has a target of 10-12% by 2030. Total visitors are estimated to be 5.2M this year compared to 5.08M in 2024. In 2010, total visitors were about 1.1M and in 2023 it was 4.05M (post-World Cup). The significant increase in tourism is most likely driven by the World Cup, the port and Hamad International Airport. The Doha port has become a popular cruise stop with 396,000 passengers (87 ships) arriving in 2024 compared to 275,000 (55 ships) in 2022. The Hamad International Airport in Doha is a major travel hub with an estimated 52M air passengers this year. The airport is also being expanded and is expected to have a 70M air passenger capacity. The Qatar government is also investing a lot in healthcare infrastructure to be a medical tourism destination.

The Switzerland of the Middle East

Qatar has quietly positioned itself as a neutral negotiator and influential player on the world the stage. There are three main pillars to their strategic position which will definitely have economic impact in the near and long-term.

Diplomatic Access: Qatar hosts peace talks and maintains open channels with both Western powers and regional actors.

Media Power: Al Jazeera is Qatar based major global media company and amplifies Qatar’s soft power- shaping global narratives and challenging Western media dominance.

Military Leverage: Qatar hosts the largest U.S. airbase in the region (Al Udeid) and recently opened a new base in South Carolina, deepening bilateral trust with the US.

This triad—access to diplomacy, media, and defense—makes Qatar a quiet but potent player in world affairs.

The Blockade

In June 2017, Saudi Arabia, the UAE, Bahrain, and Egypt made a land, air, and sea blockade on Qatar, accusing it of supporting terrorism and aligning too closely with Iran—claims Qatar firmly denied. Rather than concede to the demands issued by the blockading countries, Qatar launched a strategic pivot that reshaped its economic and geopolitical posture.

The Qatar Stock Exchange fell 8%, a food supply crisis emerged as Saudi land routes closed, and airspace restrictions disrupted Qatar Airways and regional logistics. In response, Qatar diversified its trade partners by increasing imports with Turkey, Iran, Oman, and Pakistan, while upgrading Doha Port and Hamad International Airport to reduce reliance on the GCC. They also accelerated domestic production with initiatives like Baladna, a massive dairy operation that replaced Saudi imports, and expanded local agriculture and industrial capacity. The blockade lasted four years. Though intended to isolate Qatar, it instead catalyzed its transformation into a more defensible, diversified, and globally connected economy. Today trade has largely recovered with the blockade countries and Qatar continues to strengthen their new economic and diplomatic partnerships.

Demographics

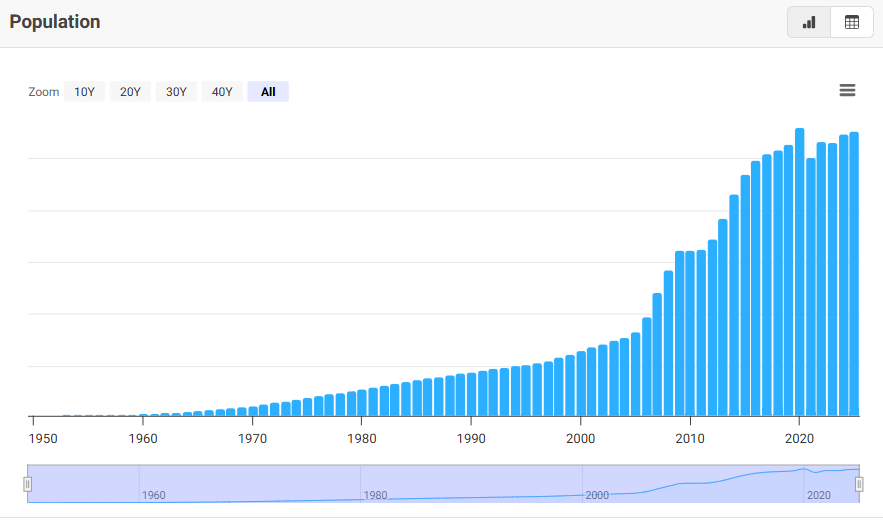

Qatar is a small nation with a total population of about 3.12M. Like many Gulf States the majority of the population is (94%) expats from South Asia and the broader Middle East. There is also an increasing about of expats from Europe and North America (5%-8%). Qatari citizens are only about 360,000 and non-Qatari citizens about 2.76M. The median age is 33 years and 97% of residents live in Doha and Lusail. Since 2000, the population has grown 428% and average annual growth about 7.1%. The population grew 2.2% and 7.6% in 2025 and 2024. The growth is driven mainly by migration given fertility rates are below replacement. Given the economic growth and government easing of immigration controls the population is expected to continue to grow (4.16M by 2050). An example of this easement is the recent lowering of the investor visa requirement to just $200,000 from $1M.

Expats in Qatar

Historically the expat population has been largely transient with stays about 2-10 years. However, this is slowly changing with many expats choosing to stay longer. There are an estimated 300,000-350,000 long-term expats (10+ years) and about 63% expats recently surveyed reported satisfaction with life in Qatar. Qatar offers economic opportunities, safety, and solid education and healthcare systems. The cost of living is lower than the UAE and Bahrain, but higher than Oman and Saudi. The Qatari government is also committed to attracting more long-term residents offering new investor visas and benefits for permanent residents.

Two Residency by Investment Programs

The Qatari visa investment programs are some of the bests in the region and in the world. You can even qualify with multiple properties and if you purchase with a mortgage. That means you can have renewable residency visa with as little as $80,000. The permanent residency permit gives you access to many citizen-only benefits like free education and healthcare.

Labor Market

The total labor force is about 2.18M and Qatari nationals about 125,000 (up 3% from 2024). The majority is employed by the private sector with the government sector employing only 12% of the labor force. The unemployment rate is estimated to be 0.11% and the employment rate 87.3%. Average monthly wage grew on average 2.3% annually since 2015 and went from $2,800 to $3,443 (25% from 2015-2023). It is estimated to be $3,500 in 2025 (up 1.6%). The government introduced a minimum wage in 2021 of QAR 1,000 ($274) /month + housing/food allowances. The Qatar government expects to create 250,000-300,000 new jobs by 2030. The new jobs are expected to be in AI, healthcare, tourism, and tech. Between 2015- 2025, 500,000 new jobs were created given the FIFA World Cup and push to diverse away from LNG.

Economic Challenges

Affordability

Vulnerable to oil price volatility

Low Qatari birthrates and dependency on foreigner workers

Geopolitical tensions (or at least the perception of)

Real Estate Market

Q2 2025 residential transactions were 1,844 or $2.53B up 114% from the same period last year. Doha, Al Daayan and Al Wakrah saw 126%, 164%, and 127% increases in transactions. Apartments average sale price increased 3.5% and villas saw a slight decline of 4% in Q2 2025. Land sales were up 85%. The real estate market was in decline from 2015 and 2021 due to a decline oil price, the blockade, oversupply from the World Cup, and the pandemic.

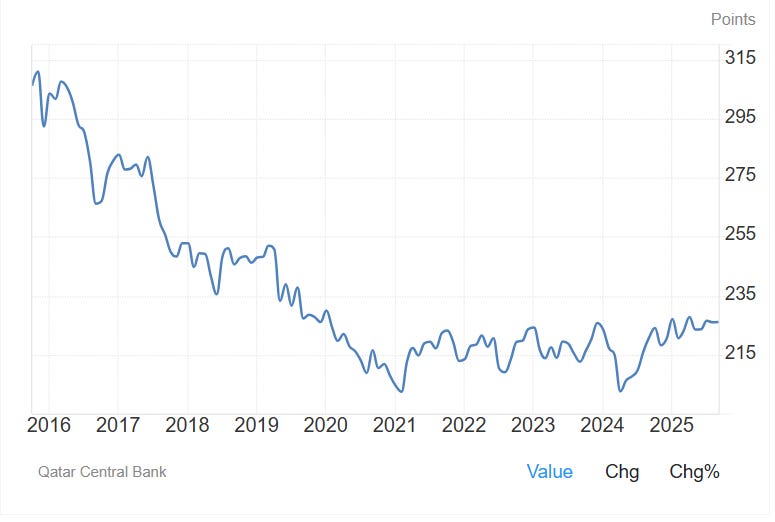

The real estate price index peaked at 311 in 2015 and declined over 35% over the next six years, bottoming at 202.5 in 2021. Since 2021 market has stabilized and showed signs of recovery. There was a short-term boom in 2022 and a correction in 2023 and 2024. Directly after the World Cup, transactions decreased 19% from Jan-Nov (2023) but bounced back that late fall (28%). In 2024, mortgage transactions hit a 5-year high of $6.9B and residential transactions were 3,548 (3,579 in 2023). This momentum is expected to continue in the near term as economy grows, interest rates decline, and supply remains stable. The new investor visa should also drive growth especially for the non-luxury sector.

Supply and Demand

After the World Cup build up, there about 15,000- 20,000 excess units mostly in Lusail, West Bay, and The Pearl. Rental rates dropped 10%-15%. To address this issue, the government has expanded freehold zones, made visa reforms, repurposed units and coordinated more closely with developers. Much of the overbuilding was luxury and short-term housing not suitable for long-term or mid-income renters (most of expats). As a result, the government has pushed developers to build less luxury housing and in only non-saturated areas. The market is slowly absorbing the excess supply. Supply of residential units is projected to grow 14,000 units by the end of 2026 (up 3.5%).

Demand is solid and expect to grow in the long-term. Owner-occupied housing is about 60-65% of the market and rentals the remaining about 35-40%. Given the demographics, it is clear that many expats are purchasing instead of renting and that trend should continue. Foreign Direct Investment was $3.2B in 2024 and expected to exceed 3.5B in 2025. Real estate accounts for about 18-22% of FDI. FDI before the blockade was about $1.07B and dropped 90% after the blockade. Unlike many in the GCC, the majority of real estate activity is from domestic buyers not investors. Given that reality, demand will be strongest in non-luxury housing.

Rents are expected to grow 12.4% rebounding from sharp declines in 2024. Before the blockade, rents grew 6.2% and 8.1% in 2015 and 2016. Between 2005 and 2015, the average annual rent growth was about 6.8%. Given the low inflation and interest rates combined with strong demand, rents will likely grow 3-4% annually in the near-term.

The Real Estate Price Index

Property Price Growth by Area (Last Five Years)

Lusail= +25% (-18% from 2015 peak)

The Pearl= +22% (-20% from 2015 peak)

West Bay= +18% (-23% from 2015 peak)

Onaiza= +19% (-8% from 2015 peak)

Al Dafna= +22% (-12% from 2015 peak)

Al Kharaej= +21% (-11% from 2015 peak)

Al Khor Resort= +19% (-17% from 2015 peak)

Jabal Thuaileb= +22% (-6% from 2015 peak)

Al Wakar= +25% (+1% from 2015 peak)

These are the nine freehold zones where foreigners are allowed to own property. I don’t necessarily think these zones are fundamentally undervalued based on the 2015 peak. In 2015 properties were overvalued and before a normal market correction could happen the country was blockade and hit with the pandemic. Mid-tier zones with affordable entry points are recovering the fastest, nearing the 2015 peak while luxury areas lag behind.

Investment Potential

Before we get into the numbers, it’s worth noting two things. First non-residents can get mortgages in Qatar, and the terms are pretty good. You can get more information here. And second, Qatar has no income tax, property tax, capital gains tax or inheritance tax.

Short-term Rentals

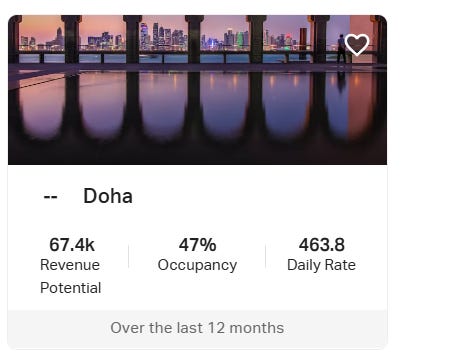

AirDNA (Metrics are in QAR not USD)

Airbtics on Doha

Average Annual Revenue: $25,000

Average Monthly Revenue: $2,113

Average Daily Rate: $144

YOY Revenue Growth: +15.2%

Occupancy: 43% (Peak Season 74%)

Active Listings: 321

Peak Season: Dec/Nov

There is definitely a STR play especially if you focus on zones like Lusail, The Pearl and West Bay. You do have to obtain a short-term rental license, properly classify the property, and there are some safety and insurance requirements. The licensing process is fast and estimated costs are $550-$1,200 per year. Keep in mind its highly seasonal given the very hot summers. I think a hybrid strategy could be interesting. For example, you rent on Airbnb during the peak season and have a mid-term tenant during the spring/summer months.

Long-term Rentals

I lean more towards LTRS given the strong demand, stable returns, low vacancy rates, and the large expat presence. The tourism sector is growing, but occupancy rates remain low on average and highly seasonal. It also seems non-luxury properties have the best investment potential for cash flow and capital appreciation. Areas like Lusail, Al Wakrah and The Pearl offer solid yields, capital appreciation, lower prices and stable occupancy rates.

Lusail- A smart city 15km north of Doha with strong demand from expats and studios starting at $170k

Al Wakrah- A coastal city south of Doha near Hamad Airport and major hospitals. High demand from healthcare workers, airport staff and mid-income families. 2 Bedroom apartments start at $219k.

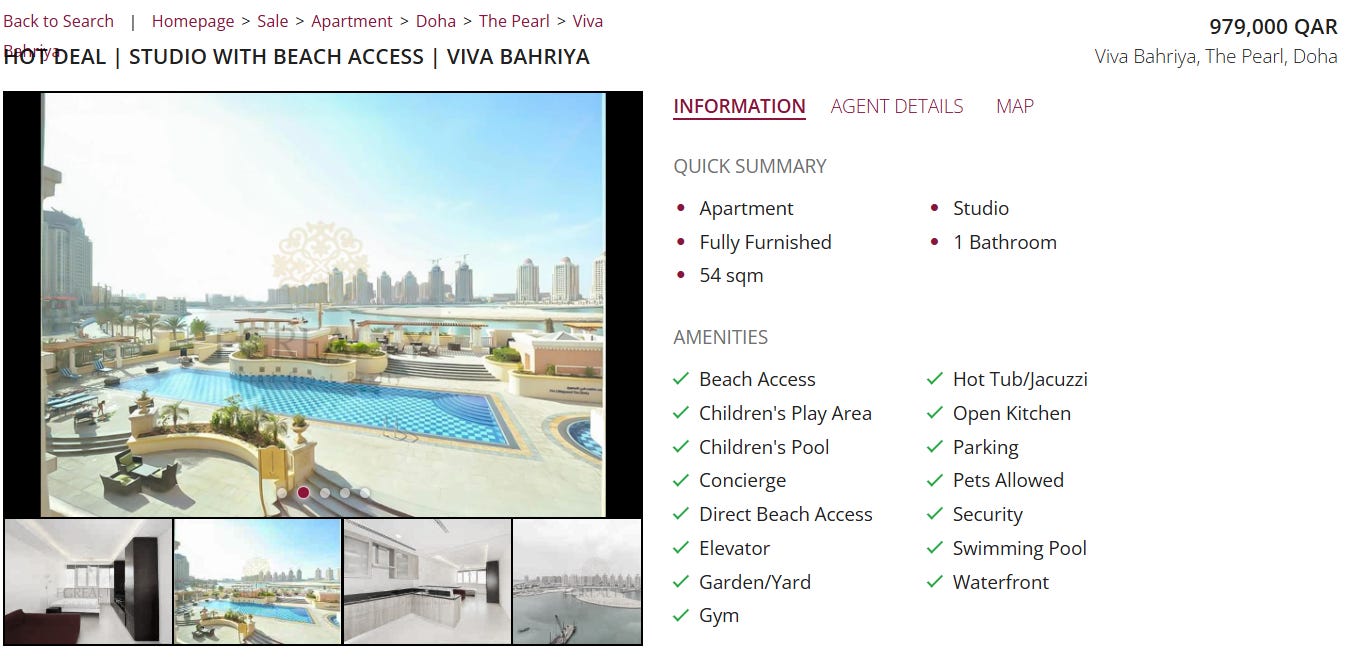

The Pearl- Luxury artificial island off the coast of West Bay Lagoon, north of central Doha. Demand is largely from GCC nationals, diplomats, and wealthy expats- studios start at $268k

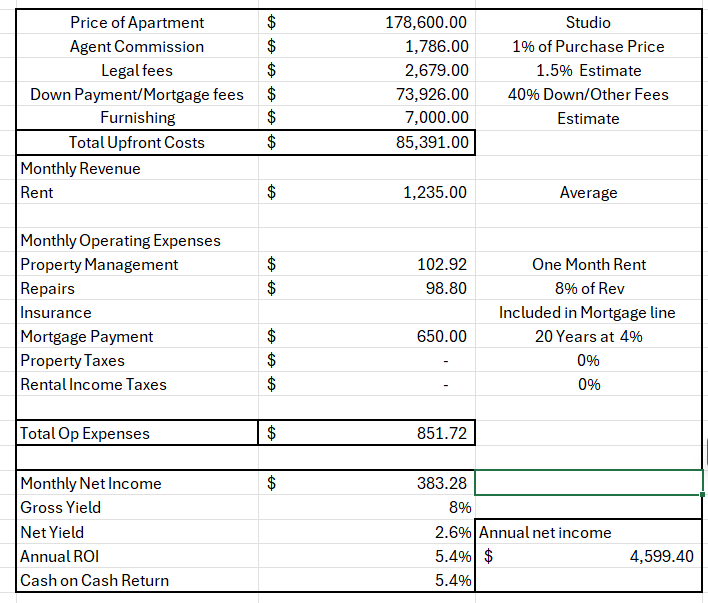

Case Study of a LTR Studio in Lusail

The estimates are conservative, and the studio is in a more affordable area in Lusail called Fox Hills. For non-residents you have to put down 40% and loan terms are 20 years.

Thanks for your readership. If you have questions about Qatar or investing somewhere else feel free to reach out. Also, if you have any suggestions of where I should cover next, let me know.